Edward Thorp Wife

Dec 20, 2020 James Kimo Keiter-Charles, 38, of Honokaa died Nov. 24 at North Hawaii Community Hospital. Born in Honolulu, he was a state Child Protective Services investigator, former basketball player for the University of Hawaii at Hilo Vulcans and member of the 2000 Hilo High School Vikings state championship basketball team. Services at a later date. Survived by wife, Cecile Walsh of Honokaa; parents. Thorp; Ken Uston; Al Francesco; Stanford Wong; Tommy Hyland; Arnold Snyder; Peter Griffin; Philanthropy. In 2003, Edward O. Thorp and his wife, Vivian, donated $1 million to the University of California, Irvine, to attract promising mathematicians to the college. According to Thorp, “Vivian and I have greatly benefited from the. Genealogy profile for James Edward Thorp James Edward Thorp (1839 - 1899) - Genealogy Genealogy for James Edward Thorp (1839 - 1899) family tree on Geni, with.

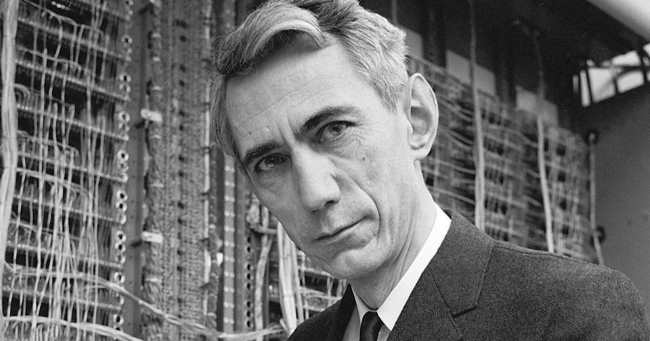

“Edward O Thorp is the author of Beat the Dealer, which was the first book to prove mathematically that blackjack could be beaten by card counting, and Beat the Market, which showed how warrant option markets could be priced and beaten. He also was the co-inventor of the first wearable computer along with Claude Shannon. Thorp also pioneered the use of quantitative investment techniques in the financial markets (Option Arbitrage, Warrant Modeling, Convertible Arbitrage, Index Arbitrage and Statistical Arbitrage).”

Thorp speaks clearly and from the heart. He reminds me of that other ultra rational decision maker Charlie Munger. Despite his prodigious intellectual gifts Thorp remains grounded and approachable. A few sentences reveals his gift for communication which reminds me of Michael Mauboussin:

“My life has been an adventurous journey I thought readers would enjoy my stories of the people I met and the challenges I faced.”“Chance can be thought of as the cards you are dealt in life. Choice is how you play them.” “A lot of big choices that you make at some point or other, and then there are things that you can’t control like who your parents were, and what kind of economic circumstances you were brought up in, where you started. Did you start 20 yards behind the start line or 20 yards ahead of it, or right on it? People start in different places. Those are cards that are dealt.”

Beat The Dealer Edward Thorp

Set out below are usual twelve lessons I have learned from Thorp:

- “Try to figure out what your skill set is and apply that to the markets. If you are really good at accounting, you might be good as a value investor. If you are strong in computers and math, you might do best with a quantitative approach.” “If you aren’t going to be a professional investor, just index.”

Edward Thorp Beat The Market

Thorp likes to stay within his circle of competence. This is a hallmark of people who are rational. In that sense, Thorp reminds me of Warren Buffett. But unlike Buffett, Thorp did not make his fortune in the market by analyzing businesses and instead found his special competency in statistical arbitrage, which he more or less invented. Thorp was able to successfully take his considerable mathematical and intellectual gifts and apply them in an area where he has a significant advantage.

- “The way I sized up the Ben Graham approach was that it would be a total lifetime of effort. It was all I would be doing. Warren demonstrated that. He’s the champion of champions. But if I could go back and trade places with Warren, would I do it? No. I didn’t find visiting companies something I wanted to do. I never even thought about finance until I was 32.”

Thorp also decided early in life to get in the side car of other people who have a different competitive advantage. He invested in Berkshire when the stock was trading at $982 and still hold those shares today. When Buffett was winding up his partnership he was asked to do some due diligence on Thorp as an investor by a mutual friend. That chain of events resulted in Thorp and his wife playing bridge with Buffett in 1968. Thorp described the meeting: “The Gerards invited my wife Vivian and I to dinner with Warren and his charming blonde wife Susie. Impressed by Warren’s mind and his methods, as well as how far he’d already come, I told Vivian that he would eventually become the richest man in America. A mutual friend talked recently with Warren, who spoke warmly of our meetings, of Beat the Dealer and Beat the Market, and of non-transitive dice.”

Speaking of impressive mental calculation, Barry Ritholz recently interviewed Thorp and watched him calculate his return on his Berkshire shares in his head. Thorp is the sort of person who taught himself FORTRAN so he would create his card counting techniques for Blackjack on an IBM 704 mainframe. The number of things Thorp taught himself is astounding.

It is a good thing to remember that you are not Ed Thorp, Warren Buffett or Charlie Munger and neither and I. If you have similar mathematical gifts as Ed Thorp or Buffett, good for you. I do not have them. Even if you have those mathematical gifts, are you are rational as Thorp? Do you have control of your ego sufficiently to stay within your circle of competence?

- “The first group of investors are those who do not want to do a lot of work who should invest in indexes. Index investors do better than maybe 90% of all other investors who are busy paying fees to advisers.” “The second group are those who would like to learn more about securities. They are entertained by following and analyzing securities. I think they can learn about special, unusual things although there is a price for that education. [They are] interested in the market, and it’s kind of fun for them. Those people if they want to learn more should go out and have their go at trying to make some money, but they shouldn’t use the bulk of their resources to do this. If they find something that really works then they can start putting more money into it. They’ll find that most of the time they haven’t really found anything that really works.” “The third group, which are the professional people some of whom actually get an edge. Most of whom don’t, but some of whom do. Those people get a start somehow in the market just like I got a start with an option’s formula, so I have an edge. I get in. I build an organization, which is small, and it gradually grows. It gets more and more skills. It gets into more and more kinds of investing. You, basically, get over the hurdle and get yourself established. If you can do that as a professional then you’re kind of on your way to collecting what people call Alpha, excess return. Then there’s the fourth group, which I don’t have much interest in, and those are the ones who are simply asset gatherers. They’re in there to collect fees and get rich, but there’s nothing really very interesting in what they do.”

In which category do you fit? Do you enjoy learning a lot about businesses? Are you willing to devote many hours a day to researching businesses? Have you tried picking stocks with a small portion of your assets and carefully tracked results to see if you are any good at it?

- “[Slot machines are] the most moronic devices ever, one of the stupidest activities of humankind. People play negative-expectation games. That’s something I’m not willing to do. I’ve never even bought a lottery ticket.” “The first thing people who have control do is tilt the playing field. Maybe the majority of wealth is accumulated because of tilted playing fields. Not because of merit.” “In standard gambling games in casinos you can generally calculate what the casino’s edge is, or if you figure out how to count cards you can calculate what your edge over the casino is. It’s a fact, a mathematical fact, that if you play a game like this and the casino has the edge it will eventually collect all your money if you play long enough. On the other hand, if you have an edge your bankroll will grow and grow and grow. Basically, what happens is your bankroll either grows or shrinks depending on what your edge is or what your disadvantage is. There’s luck that pushes it up and down around that growth curve. That’s the way things look in the gambling world.”

If you look carefully at what Thorp has accomplished with his funds he was not gambling if you define it as a “negative net present value” activity (which you should). Thorp only invested when he had a statically generated advantage or as he calls it “an edge.” I have never bought a lottery ticket either. I would rather drop a large rock on my toe than gamble.

- “The overlap of interest between gambling and the stock market is very high. There are so many similarities and so much one can teach you about the other. Actually, gambling can teach you more about the stock market than the other way around. Gambling provides an analytically simpler world, and you can see principles and test theories.” “I chose to investigate blackjack.” “I was lucky in that I came at investments through blackjack tables. And the blackjack tables are an amazingly good training ground for learning how to invest, how to think about investments, how to manage them. And the reason is that they teach you, on the one hand, to use probability and statistics to evaluate things. And on the other, they teach you discipline. When you find something, you stick to it. “Most of the games, whatever happens on one trial or one play of the game doesn’t have any influence on what’s going to happen next. I realized that in a minute or two that if cards were used up during the play of the game, the odds would shift back and forth – sometimes for the casino, sometimes for me.” “Say a blackjack player is dealt a ten and a six, while the dealer’s showing a ten. You can calculate that situation, and anyone who’s played any cards knows you’re ‘supposed’ to hit. But what if your 16 is comprised of two fours and four twos? In a deck that’s ten rich, it’s a definite stand.” “Beating the blackjack tables by keeping track of the cards was, though I didn’t realize it until later, a preparation without equal for successful investing. When I had the edge, I bet big, but not so big as to risk going broke. When the cards favored the casino, I played defense, to limit my losses. The same approach worked on Wall Street: the bigger my edge, the more I bet and the greater the risk the more cautious I was. Gambling and investing are alike – in both you risk money, which you then may win or lose.”

Again, the comparison to the methods of Charlie Munger is easy. Munger has said: “Life in part is like a poker game, wherein you have to learn to quit sometimes when holding a much loved hand….Playing poker in the Army and as a young lawyer honed my business skills … What you have to learn is to fold early when the odds are against you, or if you have a big edge, back it heavily because you don’t get a big edge often.”

- “One of the early things that I learned, fortunately, which was how much to bet on good situations. If you bet too much you’re likely to be wiped out. If you bet too little it takes forever to make any money, so there’s a happy medium.” “You have to make sure that you don’t over-bet. Suppose you have a 5% edge over your opponent when tossing a coin. The optimal thing to do, if you want to get rich, is to bet 5% of your wealth on each toss — but never more. If you bet much more you can be ruined, even if you have a favorable situation. It’s a formula Bell Labs scientist John Kelly devised in the 1950s for maximizing the long-term growth rate of capital. It tells you how to allocate your money among the choices available, and how much to invest as your edge increases and the risk decreases. It also avoids the over-betting that can ruin an investor who otherwise has an edge.” “There are, however, safer paths that have smaller draw downs and a lower probability of ruin. If you bet half the Kelly amount, you get about three-quarters of the return with half the volatility. I believe that betting half Kelly is psychologically much better…. sometimes the dealer will cheat me. So the probabilities are a little different from what I calculated because there may be something else going on in the game that is outside my calculations. Now go to Wall Street. We are not able to calculate exact probabilities in the first place. In addition, there are things that are going on that are not part of one’s knowledge at the time that affect the probabilities. So you need to scale back to a certain extent because over betting is really punishing—you get both a lower growth rate and much higher variability. Therefore, something like half Kelly is probably a prudent starting point. Then you might increase from there if you are more certain about the probabilities and decrease if you are less sure about the probabilities.” “In the last 15 years or so, there has been a large flow of capital into the hedge-fund world, from $100 billion in the early 1990s to $2 trillion now. But the amount of available investing opportunities hasn’t increased that much. That has led to the over-betting phenomenon [which can result in] gambler’s ruin.”

I remember when I first started reading about the Kelly criterion in books and essays written by Robert Hagstrom and Michael Mauboussin. It was a revelation. Imagine how cool it would have been to be a fly on the wall when Thorp and Claude Shannon were having conversations at MIT. Or learning and debating with Richard Feynman. Thorp has had such an interesting life, but the idea of he and Shannon developing the world’s first wearable computer to beat casinos at roulette is Ocean’s Eleven type stuff. In a paper detailing the shenanigans Thorp writes:

“The final operating version was tested in Shannon’s basement home lab in June of 1961. The cigarette pack sized analog device yielded an expected gain of +44% when betting on the most favored “octant.” The Shannons and Thorps tested the computer in Las Vegas in the summer of 1961. The predictions there were consistent with the laboratory expected gain of 44% but a minor hardware problem deferred sustained serious betting. We kept the method and the existence of the computer secret until 1966.”

Thorp was smart and rational enough to have avoided the gambler’s ruin that caught Long Term Capital Management. Elliot Turner describes a talk Thorp gave at Sante Fe Institute:

“Thorp described their strategy as the anti-Kelly. The problem with LTCM, per Thorp, was that the LTCM crew ‘thought Kelly made no sense.’ The LTCM strategy was based on mean reversion, not capital growth, and most importantly, while Kelly was able to generate returns using no leverage, LTCM was ‘levering up substantially in order to pick up nickels in front of a bulldozer.’”

Turner also notes: “It’s been mentioned that both Warren Buffett and Charlie Munger discussed Kelly with Thorp and used it in their own investment process.”

- “I think inefficiencies are there for the finding, but they are fairly hard to find.” “Markets are mostly good at predicting outcomes, but very bad at anticipating black-swan events.” “When people talk about efficient markets they think it’s a property of the market, but I think that’s not the way to look at it. The market is a process that goes on, and we have depending on who we are different degrees of knowledge about different parts of that process.”

Thorp’s track record as an investor makes a mockery of anyone who believes in the hard version of the efficient market hypothesis. Elliot Turner gives summary of Torp’s approach and results as a hedge fund manager:

“In 1974, Thorp started a hedge fund called Princeton/Newport Partners [which] used warrants and derivatives in situations where they had deviated from the underlying security’s value. Each wager was an independent wager, and all other exposures, like betas, currencies and interest rates were hedged to market neutrality. Princeton/Newport earned 15.8% annualized over its lifetime, with a 4.3% standard deviation, while the market earned 10.1% annualized with a 17.3% standard deviation (both numbers adjusted for dividends). The returns were great on an absolute basis, but phenomenal on a risk-adjusted basis. Over its 230 months of operation, money was made in 227 months, and lost in only 3.”

Edward Thorp Net Worth

- “When the interests of the salesmen and promoters differ from those of the client, the client had better look out for himself.”

Thorp knows that you should never ask a barber if you need a haircut. There are few things as powerful in human affairs as incentives. Both at a personal level and in society as a whole, incentives are the dominant cause of outcomes. The more you understand the impact of incentives, the more you understand life.

- “When there’s money and not full accountability, whether it’s in casinos or on Wall Street, there’s going to be stealing and cheating.” “My book tells how you have to be aware of cheating in both of these worlds. At blackjack, it can be marked cards, second-dealing, or a stacked deck. On Wall Street, it can be Ponzi schemes and other frauds, such as insider trading, fake news, or stock price manipulation. Mathematically, the biggest difference is that the odds can be figured exactly or approximately for most gambling games, whereas the numbers are usually far less certain in the securities markets.”

Munger not surprisingly agrees with Thorp: “Where you have complexity, by nature you can have fraud and mistakes. The cash register did more for human morality than the Congregational Church. It was a really powerful phenomenon to make an economic system work better, just as, in reverse, a system that can be easily defrauded ruins a civilization.” One of the reasons Thorp uses a fractional Kelly approach isthat it provides some protection against fraud.

- “Most stock-picking stories, advice and recommendations are completely worthless.” “Sell down to the sleeping point. As far as asset classes go, it is hard to know when you are in a bubble, and if you are in one, when it will pop.” “I read a good book recently, Superforecasting by Dan Gardner and Philip Tetlock. They wanted to see whether people can forecast better than chance. What they found is that experts often do not have much to tell us things of value. Experts receive a lot of media attention because they make strong, definite claims. But definitive claims are usually not accurate predictions; we can only see the future fuzzily. People that tend to weigh different possibilities can make somewhat better predictions than chance.”

The most effective way to learn this lesson is the same way you learn not to touch a hot stove as a child. But the better way is to watch someone else do it. “Just say no” to stock tips. Bernard Baruch described why stock tops are so appealing to some people in this way:

“Beware of barbers, beauticians, waiters – of anyone – bringing gifts of ‘inside’ information or ‘tips’. The longer I operated in Wall Street the more distrustful I became of tips and ‘inside’ information of every kind. Given time, I believe that inside information can break the Bank of England or the United States Treasury. A man with no special pipeline of information will study the economic facts of a situation and will act coldly on that basis. Give the same man inside information and he feels himself so much smarter than other people that he will disregard the most evident facts.”

- “People say, ‘Gee, what if your Berkshire goes down?’ I say, ‘Oh, that’s good because now I can buy more’” They say, ‘But what if it goes up?’ I say, ‘Well, that’s good too because I feel good because I feel suddenly richer.’ So let it go up or let it go down. I don’t care.”

This statement by Thorp is a variant of a point Warren Buffett likes to make:

“This is the one thing I can never understand. To refer to a personal taste of mine, I’m going to buy hamburgers the rest of my life. When hamburgers go down in price, we sing the “Hallelujah Chorus” in the Buffett household. When hamburgers go up, we weep. For most people, it’s the same way with everything in life they will be buying–except stocks. When stocks go down and you can get more for your money, people don’t like them anymore.”

P.s.,

- At the 2017 Daily Journal of Commerce annual meeting Charlie Munger recommended Thorp’s autobiography A Man For All Markets. Thorp tells this story about attending a Berkshire meeting in Omaha:

“Saturday night we were back at Gorat’s! The price of the T-bone dinner we had Friday was, as a “special for shareholders,” now $3 more! Charlie Munger reluctantly ‘worked’ the room we were in and I mentioned to him a tale I’d heard about his youth. Charlie had gone to Harvard Law School and, when a friend of mine got his degree there a few years later, he found that Charlie was a legend – with many saying he was the smartest person ever to have attended. As a first year student Charlie was said to have regularly intimidated professors in the classroom. While autographing my menu, Charlie said (perhaps sadly) ‘That was a long time ago … a long time ago.'”

2. “Warren Buffett once challenged Bill Gates to a game of dice. ‘Buffett suggested that each of them choose one of the dice, then discard the other two. They would bet on who would roll the higher number most often. Buffett offered to let Gates pick his die first. This suggestion instantly aroused Gates’ curiosity. He asked to examine the dice, after which he demanded that Buffett choose first.” Buffett was using a set of non-transitive dice! An explanation of these dice is here: https://www.microsoft.com/en-us/research/project/non-transitive-dice/

“From “Fortune’s Formula”, by William Poundstone 2005:

“The dean of UC Irvine’s graduate school, Ralph Gerard, happened to be a relative of legendary value investor Benjamin Graham. Gerard was then looking for a place to put his money because his current manager was closing down his partnership. Before commiting any money to Thorp, Gerard wanted his money manager to meet Thorp and size him up. “The manager was Warren Buffett. Thorp and wife [Vivian] met Buffett and wife for a night of bridge at the Buffetts’ home in Emerald Bay, a community a little down the coast from Irvine. Thorp was impressed with Buffett’s breadth of interests. They hit it off when Buffett mentioned nontransitive dice, an interest of Thorp’s. These are a mathematical curiosity, a type of “trick” dice that confound most people’s ideas about probability.”

Notes:

Categories: Uncategorized